Contents:

1. Basic information about Bitcoin and the chart

2. Summary of the Bitcoin rate for the years

– Period 2009-2015

– Period 2016-2020

– Period 2021-2024

3. Current analytics on Bitcoin in 2024 by years

4. An example of how to analyze BTC and its value

5. Examples and types of Bitcoin analysis:

– technical analysis

– fundamental analysis

6. What affects the price of Bitcoin

7. Early demand in the Bitcoin supply market

8. Cryptoindustrial events

9. Educational program on CYBER attacks

10. The impact of Bitcoin on the rates of other currencies (altcoins)

11. Summary

Introduction

The beginning of 2009 is the beginning of Bitcoin’s journey. No one could imagine that something like this could cost more than one thousand dollars. Then bitcoin was thrown away just for registration, and now its cost has reached $99,000 (!) for 1 BTC. Everyone has their own story of triumphs and falls, scandals and losses, accomplishments and wealth thanks to Bitcoin. It was not simple and is unlikely to be simpler, but one thing is certain – it is already deservedly called digital gold and it has received this merit on its way for a reason. Already now, at the time of writing, the price for 1 BTC is more expensive than the price for 1 KG of gold.

General history of Bitcoin for all time from 2009 to 2024 (now).

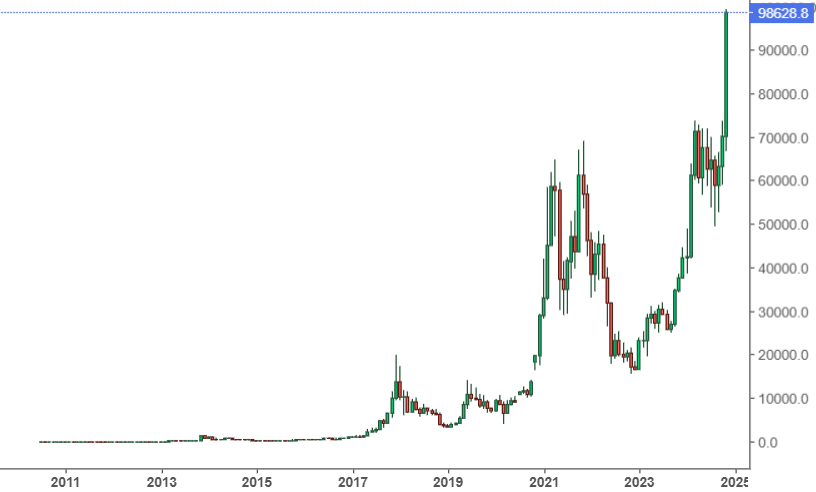

It is better not to explain but to show right away. Below is a price chart (photo #2) for BTC converted to USDT. USDT is an analogue of the dollar within cryptocurrency systems, one USDT is equal to one real dollar. The chart below is usually used for analysis to better understand the volatility of a digital asset, but in general it illustrates and covers Bitcoin from its inception to the present day and displays how the rate of the “golden” coin can be influenced by various factors and events, events within the industry or in politics, or a banal post on Twitter. Analytical data is used in different ways.

Breaks down the history of Bitcoin by year with general and main details

Here we will consider the history of Bitcoin prices to this day from the moment of its first mention and release. From almost zero value to the financial boom. Below is a table of Bitcoin prices that will display the maximum and minimum prices for the gold coin by year, where you can clearly see the % that could be obtained simply by investing in Bitcoin in a particular period of time, or simply by starting to mine it using ASIC miners on Bitcoin.

remark* – Basically, Bitcoin itself works on the SHA-256 algorithm, this is its base. The base is a level of protection, which allows you to transfer finances without fear for their safety and being confident that even for millions of years it (the storage wallet) will not be hacked.

| Рік | Максимум | Мінімум |

| 2024 | $99 300 | $39 800 |

| 2023 | $42 500 | $16 000 |

| 2022 | $47 835 | $18 490 |

| 2021 | $68 789 | $29 796 |

| 2020 | $29 096 | $3 850 |

| 2019 | $13 017 | $3 401 |

| 2018 | $18 343 | $3 217 |

| 2017 | $19 892 | $784 |

| 2016 | $981 | $351 |

| 2015 | $465 | $172 |

| 2014 | $13 | $310 |

| 2013 | $1 163 | $13 |

| 2012 | $16 | $4 |

| 2011 | $32 | $0.29 |

| 2010 | $0.40 | $0.00 |

| 2009 | $0.0041 | $0.00 |

*Currently, the Bitcoin rate reaches $99,300

History of the Bitcoin rate through the eyes of an eyewitness and a crypto-fan

History of the Bitcoin rate through the eyes of an eyewitness and a crypto-fan

The dynamics of Bitcoin prices over the years reveals important data for understanding its market trends. Below, the main aspects of pricing through the years, in the first years of its use and to this day will be described. In the table above, we can see the price, and from the description below, events and trends will be written that will help you understand what was happening at one time or another.

First phase: Creation and popularization. 2009-2015

When the first block of the cryptocurrency was created by the first founder himself in 2009, and its mysterious creator Satoshi Nakomoto (Satoshi Nakomoto), its price was $0. Who this creator is is still unknown, the person appeared on forums and interacted with other developers, but it is still impossible to reliably find out who it was. The first price that the market began to offer for Bitcoin was approximately $0.003 per coin and was set before 2010. Bitcoin experienced rapid growth closer to 2011, where it showed high volatility, rapidly soaring to $1 and very soon, fell to $0.30. The first global disappointment with Bitcoin. But this was the point from which it grew even more, by the end of 2011 it was already worth $30.

In the period 2012-2013, the price of bitcoin demonstratively grew and showed tendencies for even greater growth, at the time of 10.2013 the price of bitcoin already exceeded 1000 dollars. But 2014 became a period of “bear” market. Prices for gold coins fell by 70%, this was facilitated by various factors, including the regulation of the security of the coin, which at that time was still being finalized and fraudulent exchange firms that destroyed people’s faith in digital gold and tried to make money by taking people’s funds on the balance and using it ineffectively. At that time, millions of dollars in bitcoins were frozen on one of such exchanges. In general, from 2014 to 2015, the price of bitcoin fluctuated from 200 to 500 dollars, even despite those problems – people’s trust was preserved. Phase One: Gaining Trust. 2016-2020

Already in 2016, the price for one Bitcoin reached an average of $430 and by the end of the year it reached $970, which indicated increasing popularity, people paid with Bitcoins for pizza, for services, on the darknet, etc. With its help, the world began to feel freer and Bitcoin began to spread around the world.

– a note* about Darknet and Bitcoin. Initially, it was conceived as a benefit, how people were already using it is another matter

But by 2017, the price had jumped sharply to $20,000, which was a stunning success. The bullish trend, in other words, people’s greed and little demand, created a vacuum that increased the price of Bitcoin, everyone wanted it, there were few offers – keep the price higher. It was no longer ordinary people who started buying it, but companies whose owners or managers also believed in this direction. But after the market correction, when the “Gold Rush” began to fade, there was less demand – more offers, sales became more frequent and Bitcoin dropped to $ 3,000. Only by 2019, after the market came to its senses, the price of Bitcoin rose to $ 7,200.

The end of the 20s became an indicator of the resilience of bitcoin and its increasing acceptance, giants began to buy it into their portfolios, Gray Skale, investment companies such as Black-rock, Wone Guard, MicroStrategy and others. The price fluctuated from $ 5,000 to $ 10,000, but by the end of the year it had already confidently reached $ 29,000.

Third phase: Gaining global trust at the level of countries and governments

During 2021, bitcoin soared to a crazy $ 60,000, this was facilitated by the institutional influence of governments and media personalities. In the following time, it fluctuated from 30,000 to 60,000 on news backgrounds and active actions of all users. Supply and demand, remember, keep in mind. Ecology regulations, for example, which created problems for Bitcoin in 2022 and held Bitcoin back from $30,000 to $50,000, this time it was able to strengthen to $45,000.

During the period 2022-2023, the price of Bitcoin fluctuated within the average range of $55,000, sometimes falling below $40,000 and rising to $60,000. Some players who continued to buy the currency at maximum prices began to suffer losses, but someone still increased their assets, such as Grayscale’s Bitcoin Trust (GBTC) felt significant losses on the off-price drop below $40,000 as companies bought hundreds of bitcoins at $55,000 and above.

Only in March-February 2024 there was a sharp shift in favor of Bitcoin due to:

– launch of ETF-spot of large financial companies from Wall Street

– popularization by presidential candidate Trump

– extremely proactive US Congress

– Argentina, which secured investment in Bitcoin on an annual basis

– popularization by media personalities

All this is a crazy growth of Bitcoin, updating its ATH to $ 69,210 on March 6, 2024, and then maintaining the trend throughout March up to $ 73,805.

Monthly value of Bitcoin in 2024

Bitcoin growth trends are impressive, the influencing factors were described above and the growth trends continue. Someone says that they are waiting for 100k, someone for 300k, someone is waiting for Bitcoin to a million

| Месяц | Максимум | Минимум |

| Январь | $48 982 | $38 467 |

| Февраль | $63 978 | $41 861 |

| Март | $73 750 | $59 288 |

| Апрель | $72 748 | $59 597 |

| Май | $71 979 | $56 512 |

| Июнь | $71 111 | $60 292 |

What can help in analyzing Bitcoin prices?

Technical Analysis

In the history of Bitcoin, it is worth paying attention to technical analysis (TA) and the analysis of the life cycle of the crypto asset to understand pricing. Technical analysis is the consideration of previous years of price ranges using charts and statistics. In the work of analysts, such tools are used: price charts and historical data and interactive platforms such as TradingView, CoinMarketCap or Binance. The basis of this method is the identification of price movements that can be repeated in the future. In conclusion, it helps traders make the right offers based on past experience of price history.

Fundamental Analysis

In this analysis, it is important that the assessment of Bitcoin is carried out from the inside, based on various factors, these can be political and financial events, some achievements in crypto-asset mining technologies.

Fundamental analysis specialists study the main parameters of the Bitcoin network, including hash rate performance, user activity and transaction turnover. This helps to assess the prospects for the development of cryptocurrency in the long term. They also do not forget that institutional adoptions, legislative initiatives, as well as general economic conditions can influence, Combining these two analyses opens access to fluctuations in the value of bitcoin, which, above all, allows you to choose the right investment solution.

Factors Affecting the Price of Bitcoin

The price of Bitcoin is dictated by various factors, mainly supply and demand, the development of the crypto industry, the value of other crypto coins and the state of blockchain technology. Here we will look at various factors.

2024 shows us that there have been significant changes in the range of the price of Bitcoin. Here we see that as demand increases, so does supply. They are usually influenced by changes in legislation, the economy and the state of affairs in the cryptocurrency market.

Supply and Demand

As in other sectors of the economy, the price of Bitcoin always depends on supply and demand. As demand increases, the price of Bitcoin also increases, because investors are willing to pay more for fewer coins. They are usually influenced by changes in legislation, the economy and the state of affairs in the cryptocurrency market.

Crypto Industry Movements

The Crypto Industry has been subject to hacker attacks on exchanges, network forks, new technological breakthroughs, deals between large partners, all greatly affect the price. The introduction of innovative solutions such as the Lightning Network can strengthen trust in Bitcoin, increasing its popularity among users and attractiveness to investors, which contributes to the growth of the price. On the other hand, negative factors such as large-scale hacker attacks or strict regulatory restrictions can provoke market panic and a sharp drop in the value of the cryptocurrency.

Cyberattacks and hacker raids

During hacker attacks, the value of Bitcoin has been greatly affected, as they devalue investor confidence and numerous coin sales occur. One of these is the hacker attack with the hacking of the Mt. Gox exchange. In 2011, the intruders were able to gain access to the system and for some time managed to reduce the value of Bitcoin to 1 cent. 2014 was marked by an even larger attack, as a result of which hackers managed to steal 850,000 BTC, as a result of which the price of Bitcoin fell several times, and the exchange went bankrupt.

Such attacks significantly reduce confidence in cryptocurrency and exchanges, which causes unnecessary price fluctuations and volatility. In turn, investors behave more cautiously, which leads to an expansion of the price range for the worse.

Cryptocurrency stabilization

Cryptocurrency stabilization usually has a very sharp effect on the price of Bitcoin, which makes investors behave more cautiously, which causes the market to fade, or, on the contrary, increases their confidence. We can consider positive stabilization as the approval of cryptocurrency ETFs, which leads to an increase in value, because it makes Bitcoin more accessible and reliable in the eyes of both institutional and retail investors. For example, the approval of Bitcoin ETF in the United States, which significantly affected the price in 2024.

Tightening regulations and bans, such as restrictions on the use of cryptocurrencies in China, have repeatedly led to a drop in the price of Bitcoin, since China is one of the largest markets for cryptocurrencies.

US Federal Reserve reports often analyze the risks and opportunities associated with cryptocurrencies, and also offer strategies for regulating this sector. In its recent reports, the Fed has emphasized the importance of increased monitoring and regulation to prevent cryptocurrencies from being used for illegal activities, which has sometimes caused a negative market reaction and led to a decline in Bitcoin prices.

Other Cryptocurrency Rates

Bitcoin also affects the rates of other cryptocurrencies. The best way to describe Bitcoin is the expression “digital gold” and it is a model for all cryptocurrencies. With its primacy and dominance, Bitcoin (BNC.D) dictates the rules of the market. Also, Etherium, showing its significant changes in value, can influence the market as a whole. Also, the correlation between Bitcoin and altcoins indicates that changes in the price of altcoins can lead to similar fluctuations in the value of Bitcoin.

Conclusion

The history of the Bitcoin rate clearly demonstrates how significantly both external economic factors and events within the cryptocurrency industry can influence the market. Since Bitcoin is the leader among cryptocurrencies, its dynamics determine market trends, and it remains under the close supervision of investors and analysts. To make informed investment decisions, it is important to consider factors such as global economic instability, changes in cryptocurrency regulation, and new technologies that can affect the value of Bitcoin. Therefore, carefully monitoring these factors can help you better predict price movements.

Feedback (0)

Leave a review